Investment Thesis

Kraft Heinz (KHC) was merged in 2015 by Berkshire Hathaway and 3G Capital. The combined entity post-merger burdened the company with $30 billion in debt at the very beginning and that led to an aggressive cost cutting strategy for increased profitability. Besides strong brand presence, the company is struggling due to increased competition from Nestle, Unilever and Mondelez.

Between 2016 and 2024 the company reduced its debt by $10 billion after selling its natural cheese and nuts businesses. Despite financial distress due to competition and an impact during Covid-19 pandemic, the company still managed to produce surplus cash of approximately $3.2 billion in 2024 and paid more than 60% of that as dividends and the rest spent on share buybacks thus reflecting brand strength and sustainability of its business and its commitment to increase shareholder’s value. Despite these efforts the stock price remained depressed over the last one year losing its value by more than 30%.

Therefore, we believe the company has a lot of potential and based on our FCF valuation KHC seems to be significantly undervalued. Its stock price is expected to double in the next 4-5 years.

Company overview

Kraft was invented by James L. Kraft in 1903 in Illinois. In 1869 Henry John Heinz founded Heinz in Pennsylvania state. These two old companies were merged in 2015 by becoming Kraft Heinz Company (KHC) as a result of a partnership between Berkshire Hathaway and the Brazilian company 3G Capital increasing its market cap to $31- 32 billion. The company since then has always generated a sustainable free cash flow even during the economic volatility and uncertainty due to non-cyclical nature of the industry.

Kraft Heinz’s, Oscar Mayer and Planters products are globally recognized and enjoy higher consumer loyalty. Kraft Heinz as a global household name and a brand has customer stickiness. It is currently undergoing a strategic tax free spin off into Global Taste Elevation Co. and North American Grocery Co. which is expected to take effect in 2026 to enhance its value for its shareholders and consumers. It operates in over 40 countries with a strong presence in North America, Latin America and Europe.

Business Model and Competition

KHC has highly irreplaceable brands which are widely available all around the world with consistent quality at affordable prices. Its core revenue is driven by the sale of condiments, sauces, ready to eat meals and cheese which covers not only households but restaurants such as McDonald’s and other culinary institutions.

They are focused on healthier and plant based options to target more customers. KHC’s availability and accessibility makes it a strong cash generating business.

Their major retail and distribution partners are some of the biggest names like Costco, Carrefour, Kroger, Amazon, and Walmart. It also has a strong financial backing by a conglomerate like Berkshire Hathaway which makes the company more reputable and reliable when it comes to the quality of the brand and products .

Kraft Heinz’s revenue is contributed by six of its product categories to a large extent; which are Taste Elevation, Fast Fresh Meals, Easy Meals Made better, Real Food Snacking, Flavorful Hydration, and Easy Indulgent Desserts. The company heavily spends on R&D and has a team that is constantly working on diversifying its product range to cater to people from different countries with varying tastes and desires.

Kraft Heinz operates in Traditional Retail method and D2C Direct- to- Consumer business model. The products they manufacture are distributed through wholesale and retail to customers. And also, they advertise through website social platforms and delivering direct to its customers.

It is a brand selling the most demanded staple household food items. Their model rely on Consumer Packaged Goods (CPG) manufacturing for its efficient performance. People are not immune to popular brands like Philadelphia, Kraft Mac and Cheese, Heinz Ketchup, Capri Sun , Lunchables. With the strong marketing and R&D budget, their global reach is unimaginable.

On the other hand one of their competitors, Kirkland is a private label owned by Costco with lower per unit cost (20%) and huge supply deals. Although, Kirkland very quickly became famous for offering high quality products at unbeatable prices. In 2021, Kirkland brand contributed their share of 31% ($59 billion) to Costco’s total revenue.

Whereas, Kraft Heinz’s SG&A cost is relatively high per unit as compared to its competitor Kirkland. Kirkland is very aggressive with their supply deals and competitive prices because they spend less on marketing and stock keeping unit (SKU). KHC’s pricing strategy is a combination of value and cost effectiveness to counter increased competition and rising inflation. Kirkland on the other hand has a strategical arrangement with their suppliers that helps them achieve higher sales at a much lower cost and reduced prices without compromising on the quality for their products.

Therefore, in order to analyze its profit per SKU , KHC maintains SKU to keep a track on their inventory levels for their extensive products range. Whereas Kirkland prefers volume and membership than high gross margin per SKU.

Kraft Heinz is a globally recognized brand and their consumers pay premium for its quality and consistency. But in recent years the shift in demand due to affordability and often more options from the new low budget grocery brands such as Goodles’ Shella Good and Bling Bling Bac’n have started gaining strength and started dominating the consumer goods market.

Adding to their success story, Kirkland and Costco built up an excellent repertoire with the best in business brands for collaboration. For instance, Starbucks produces the House of Blends roasted coffee and also Kirkland batteries are made by Duracell thus ensuring their customers get high quality products at a much affordable prices.

On the other hand, if KHC has to compete it must improve its retail shelf space for more visibility and offer discounts to boost their sales to aggressively compete with the private labels such as Kirkland that is already offering irresistibly lower prices to Costco membership card holders.

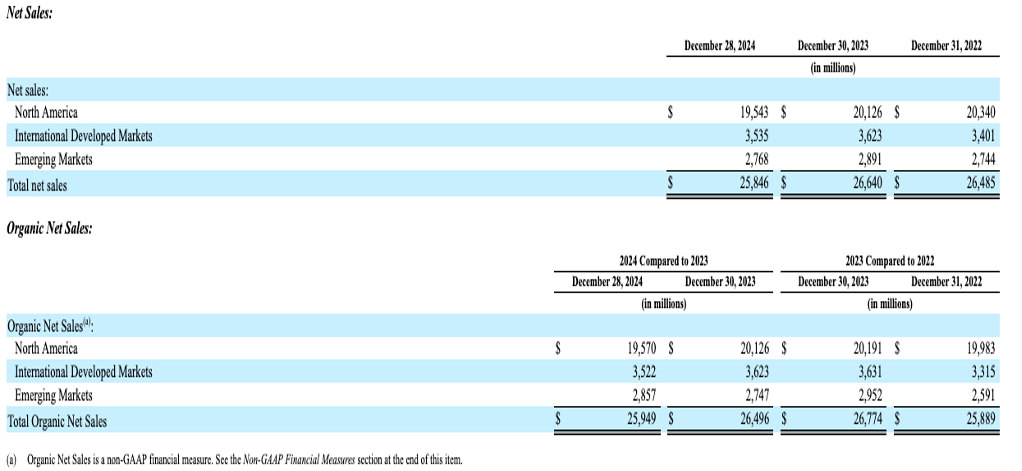

Business Segments – Geographic

The company operates in three regional business segments geographically.

- North America which covers United States and Canada.

- International Development Markets (Europe and Pacific Developed Markets)

- Emerging Markets combines two segments; Western and Eastern Emerging Markets and Asia Emerging Markets

Source: Company’s 2024 annual report (10K)

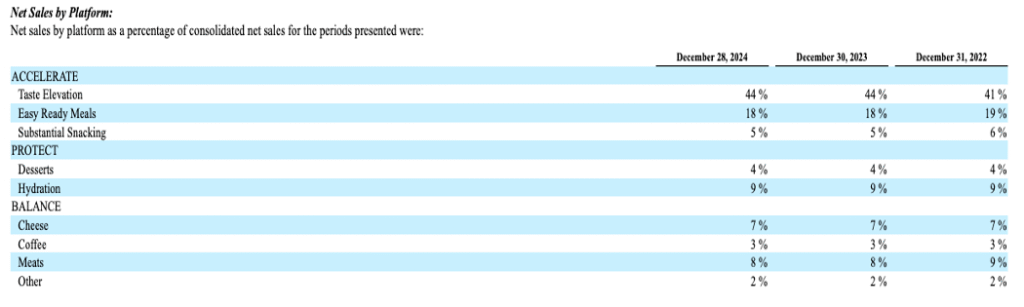

Business Segments

Kraft Heinz’s Taste Elevation is the major contributor to its revenues contributing 44% whereas Easy Ready Meals contributes 18% of revenues.

Source: Company’s annual report (10K)

Despite having a strong brand name and undertaking a major cost cut KHC has not been able to increase its free cash flows, market value and its stock price since merger. Therefore, the company did not meet its shareholder’s expectations including that of 3G exiting their position last year in 2023 leaving Warren Buffett to remain one of its largest shareholder to this day.

There were other strategies tried by the company to reduce its debt by cutting dividends utilizing its surplus cash yet it did not materially improve its financial situation. For example, in the last 10 years the company’s dividend per share is reduced from $2.3 to $1.6 in 2025 (TTM).

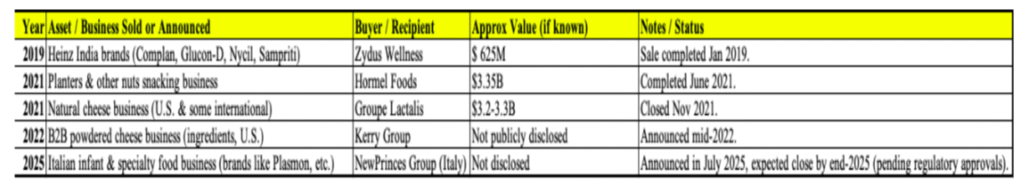

Therefore, KHC’s management is now more focused on selling off some of its assets. For example selling nut and cheese businesses in 2021 that helped reduce its debt from $25.15 billion to $19.22 billion in 2025.

In 2025, the company announced to sell its infant and specialty food business in Italy to NewPrinces S.p.A. which includes its subsidiaries, as part of its “NewPrinces Group. It includes brands like Plasmon, Nipiol, Dieterba and Aproten and Biaglut. They also sold their production facility in Italy which was being used for manufacturing some of these brands.

It is evident Kraft Heinz has changed its strategy to divesting from some of its low quality brands and businesses to improve its core business in order to strengthen its financial position and increase shareholder value.

Source: Moods Research (Data from Company’s website, annual reports and presentations)

SWOT Analysis

|

Strength |

Weakness |

|

1.Strong products Kraft Heinz products are its biggest strength. It has a wide variety of products for consumers with different tastes at affordable prices. The brands like Kraft, Heinz, Philadelphia and Lunchables are everyday staple household items. Its strong consumer base supports the stability of its cash flows for years to come. 2. Share buybacks In the last 3 years the company bought back shares worth $3 billion boosting its EPS which is a testimony that the share is undervalued at its current price. 3.Stable FCF KHC is maintaining its FCF, albeit not at a significantly higher rate, but at a decently growth rate of 9.24% (CAGR) mainly due to aggressive cost cutting measures, divestitures and other structural changes over the last 3 years. 4. High dividend yield Despite cutting its dividends KHC still has a forward dividend yield close to 6% which is very attractive to its current shareholders and other income seeking investors in the current falling interest rate environment. 5. Reduction in net debt KHC’s net debt is significantly reduced from $21 billion to $18.6 billion in 2025 over the last 3 years. |

1. Stagnant revenue growth and saturated market KHC’s yearly revenue growth almost remained flat at 1-2% or negative over the 4-5 years reflecting market saturation. The dependency on saturated north American Markets limits KHC’s revenue growth. This limitation growth in its sales is also hindering its diversification strategies in Emerging and International markets which is why the company had to divest from EU. 2.Impairment losses In 2015 KHC was merged at a much higher cost and still carries a significant portion of its assets in Goodwill which is being written down to comply with accounting principles and regulations. This impairment cost of its intangible assets is affecting its balance sheet negatively. For example in 2024 KHC had to write down a total of $3.6 billion as impairment loss on its goodwill which is quite significant. 3.Changing consumer tastesThere is also a growing trend among younger population eating organic and healthier food. Kraft Heinz has not been able to offer an effective fat free or low sodium products to consumers that could help the company grow its revenues. 4. Increased competition, depressed share price and lower shareholders returns KHC despite all its efforts to boost its share price has not been able to succeed. It had to cut its dividends that affected shareholder returns negatively over the last 4-5 years. It faces extreme competition from Nestle, Mondelez and General Mills which has affected its revenues and are not growing. It’s a sign that KHC competitors offer an attractive value to their shareholders. 5.Large layoffs and extreme cost cutting measures After a $46 billion merger in 2015, the company announced to cut 2,500 jobs, in the U.S. and Canada. The company set a target to save $1.5 billion in annual costs by the end of 2017. However, in 2019 the company had to cut more than 400 jobs to save costs. Therefore, it is expected to continue to cut more jobs in 2025 and beyond if these job cuts do not materially improve its financial situation. |

|

Opportunity |

Threat |

|

1. Product portfolio realignment The strategic divestiture of newer brands like Planters, Natural Cheeses, Italian baby food are expected to improve its margins from existing products. 2. Segment growth As a result of its focused approach to invest in value products, its Plant based sauces, Lunchables, Simply Kraft and ready to eat meals have improved sales and better margins. Moreover, the demand for western products in the Middle East, Asia and Latin America is improving which has improved its revenues from these markets. The online grocery applications on major platforms like Amazon, Walmart and Costco with direct access to consumers have helped improve KHC’s profit margins due to lowers costs. 3.Increased dividends As there are more online platforms through which the consumers can orders their groceries from the comfort of their homes, it is also an opportunity for KHC to market its brands and products aggressively to increase its revenues and margins. In turn the company can become an attractive proposition for shareholders and investors if it increases its dividends in near term. |

1.Organic and other healthier options for consumers The youth from the newer generations are more health conscious and have better organic and healthier options in the market. Unless Kraft Heinz does not revive itself and come up with healthier and organic products they will continue to struggle against competition. 2. Regulations KHC continues to face a threat from regulators especially from EU to reduce its plastic use, carbon emissions to enhance nutritional value of its products which could be very costly. 3. Higher tariffs, exchange rate volatility KHC as an American company faces significant threat of losing its consumers and revenues from some of the highly populated consumer markets like China and India because of higher tariffs imposed by the US. KHC’s business worldwide is exposed to exchange rate risks which could materially affect its profits due to higher uncertainty, volatility and devaluing currencies in jurisdictions where it operates like India and China. |

Financial Analysis

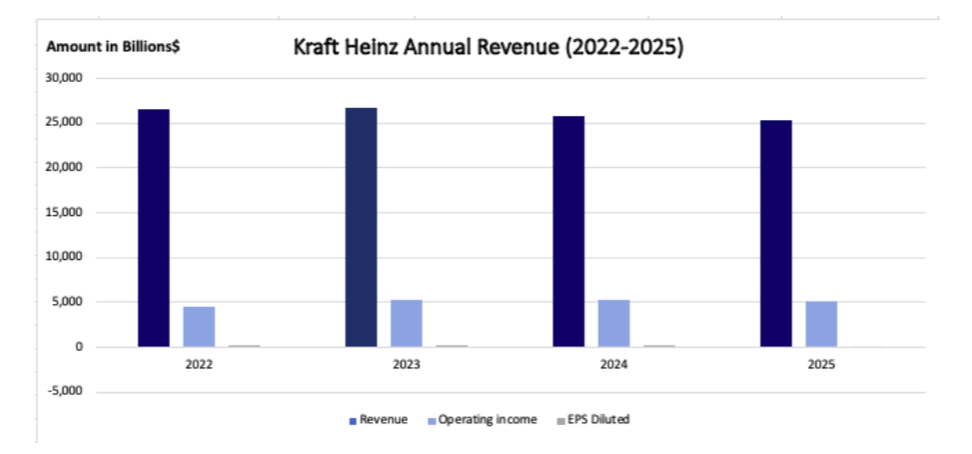

Revenue

In 2025 second quarter the recorded revenue is $25.3 billion with a last 10 years revenue CAGR of 3.57%. The adjusted operating income increased by 1.2% since 2023. Earnings per share in 2024 was $2.26 down by 2.2% as compared with 2023 due to impairment losses in 2024. Adjusted EPS in 2024 was $3.06 which is up by 2.7% compared to the previous year in 2023.

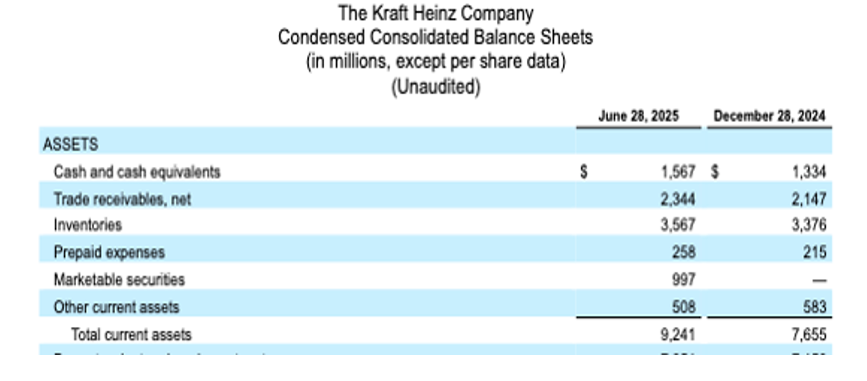

KHC’s net cash was up by 5.2% at $4.2 billion in 2024 and its free cash flow was up by 6.6% from $3.2 billion in 2023.

The operating income recorded with a loss of $8 billion in 2025 due to non-cash impairment losses of $9.3 billion and adjusted operating income loss by 1.3% in 2025.

KHC’s diluted EPS fell to significantly due to net income losses and common stock repurchases. The recorded diluted EPS in 2024 is $2.26 with 2.2% decrease from 2023. KHC’s debt to equity ratio is approximately 0.51 which is based on a total equity of $41.49 billion and $21.21 billion in total debt.

Source: Moods Research

Net Income

KHC’s net Income was $2.6 billion in 2022 and rose slightly to $2.85 billion in 2023. But the company recorded a negative net income with a substantial loss of $-6.49 billion TTM. The net income is declined by 1157.98% year over year.

However, net income has been more volatile due to company’s change in policies of using its surplus capital to pay off its long term debt, investing in marketable securities and government bonds; and foreign exchange rate fluctuations. Moreover its free cash flows have been affected due refinancing and impairment of goodwill and other intangible assets resulting in a loss of up to $3.7 billion as highlighted earlier, all affecting its performance.

Source: Company’s annual report

Source: Company’s annual report

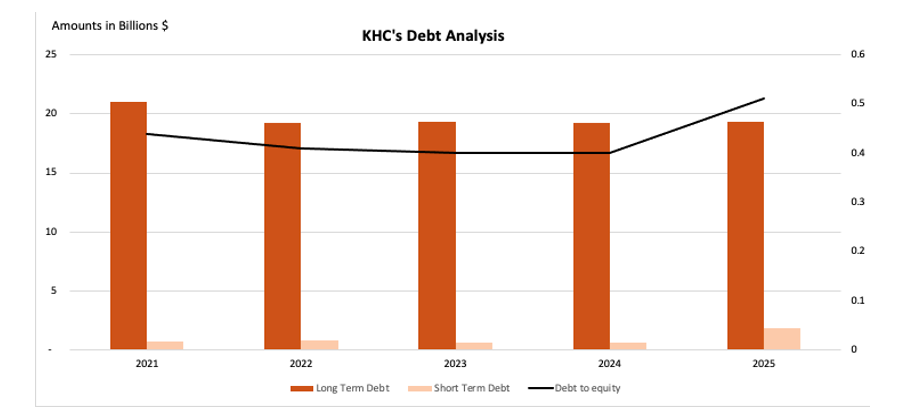

Debt Analysis

Due to Kraft Heinz’s steady cash flows, it allowed the company reduce its debt and increase cash on hand from $1.3 billion in 2024 to $1.5 billion in 2025 (TTM). With an active debt reduction policy especially post-merger, the company lowered its debt from $28 billion to $20 billion in 2021. However, any future deleveraging will entirely depend on its brands producing strong free cash flows, and other structural changes such as materialization of sale of assets that the management in effect, is trying to execute to strengthen its balance sheet.

Although; in 2023, the long term debt was $19.39 billion however, it is slightly decreased by 1% annually since then as we can see in 2025.

Source: Moods Research

Free Cash Flow (FCF)

Kraft Heinz FCF in 2021 was $4.45 billion however, in the year 2022 it dropped to $1.55 billion thus drastically declining by 65.2%. Again in 2023, its free cash flow increased to $2.96 billion reflecting a growth of 91% and in 2024 growing further to $3.16 billion representing a modest growth of 6.75% in a year. Moreover, in 2025 (TTM), the company’s FCF has increased to $3.94 billion representing a 24.6% y-o-y growth.

Share Buybacks 2021-2025 (TTM)

Kraft Heinz has repurchased $435 million of common stocks in Q2 2025 in line with its share buyback program authorized by the Board. Under this program, the company is authorized and committed to continue to buyback another $1.5 billion of common stocks.

FCF Based Valuation

Intrinsic Value

Based on KHC’s 5 years free cash flows discounted at 8% we estimate its intrinsic value to be $60.36 per share against a market price of $26.74. Its fair value reflects company’s modest yet consistent free cash flows. As a support to our thesis, the company is already making major changes in spinning off some of its non performing brands (assets). The owners are expecting to unlock true potential of the business and planning to give back more to its shareholders in 2026 after selling some of its subsidiaries.

Catalyst Driving Kraft Heinz’s Fair Value

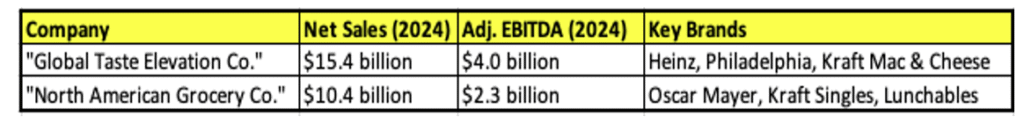

The strategic spin off in to two trading companies; North America Grocery Co. and Global Taste Elevation Co. will optimize KHC’s capital allocation strategy which in turn will improve its margins. The spinoff will improve its supply chain and manufacturing which is expected to lead to better operating margins and will raise free cash flows.

In addition, the company will focus on product innovation and will align itself to the market and consumer needs. It plans to replace artificial colors with natural food dyes by 2027. The spin off and debt reduction is expected to lower its cost of capital thus increasing its FCF and valuation. The company’s 3 months share buyback ratio was 0.50%. If the number of shares are reduced and the spin-off is carried out as planned in 2026, KHC can easily trade at about $34 per share which implies an increase of 40% in the short term.

Based on the 5 year intrinsic value calculation. The future share price value is expected to be $59. Simply by adding sum of DFCF with discounted perpetuity cash flow and dividing it with weighted average shares of KHC in 2025., we get this fair value in year 2030.

Kraft Heinz announced a tax-free spin-off for a better yet ready to compete in a highly competitive market. As per the company’s decision, KHC will split into two standalone companies, The Global Taste Elevation Company and North American Grocery Co. which is expected to be completed in the second half of 2026. No final names have been assigned to the respective companies as of yet.

The North American Co. with the key brands like Oscar Mayer, Lunchables, Maxwell House, Capri Sun, and Velveetagenerated $10.4 billion in net sales and adjusted EBITDA $2.3 billion. A total of 75% of their net sales is contributed by Oscar Mayer and Kraft Singles.

Whereby, Global Taste Elevation Co. generated $15.4 billion of net sales in 2024 and the Adjusted EBITDA was $4 billion with the major brands like Philadelphia, Heinz, Kraft Mac and Cheese. The company earns 75% of their sales through sauces, spreads and seasonings. KHC makes 20% from Away from Home (AFH) and about 20% from the emerging markets. The names of these two separate companies is not finalized yet. The debt allocation will be determined before the separation in 2026 for both the companies to ensure investment grade status.

Carlos Abrams Rivera will remain as the CEO of Kraft Heinz until he becomes the CEO of North America Grocery Co. The CEO for Global Taste Elevation Co. is still under discussion and not yet decided by the board members.

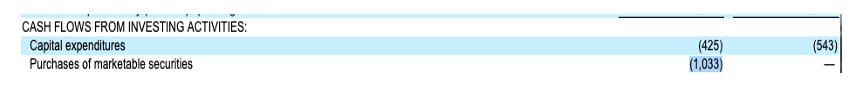

The historical drop in the Free Cash Flow was observed in the year 2022, which fell from $4.7 billion in 2021 to $1.55 billion in 2022. However, FCF has improved to $3.6 billion in 2025 TTM. Its net cash from operating activities in 2025 TTM is recorded at $1.9 billion as compared to the same period in 2025 (12.6% improvement) due to huge Working Capital (WC) improvements within accounts payable, cash outflows despite industry-wide inflation shock as a result of higher tariffs.

Moreover, due to a decrease in Capital Expenditure in 2025 the Free Cash Flow is regained at $1.5 billion which is up by 28.5% compared to 2024. KHC paid $951 million in cash dividends and repurchased $435 million of common stocks.

According to our estimates and analysis, KHC can achieve $3-3.5 billion of FCF in the next 2-3 years as a result of management improving its decision making and strategic planning to compete despite challenges such as higher tariffs once the company is split. However, achieving a higher FCF of let’s say $5 billion is unrealistic or unlikely to happen. They need to generate 125-150% of FCF or huge growth on their revenue for this to happen. It is because the revenue margins is down by 3.1% in 2025 due to competition and inflationary impact.

The company is expected to increase its FCF in 2025 from $2.2 billion in 2024 to $2.25 billion. On a lower variable compensation cash outflows with efficient working capital.

CAPEX to operating cash flow is expected to decrease due to a strong cash generating ability of up to 95% FCF conversion.

KHC is focused on growing its brand through a systematic approach. It has been observed that in case of mayonnaise they need to emphasize more on regionality. They are using a targeted media approach to optimize its growth because 75% of KHC business is concentrated in three regions. An impact of 10% growth was observed during 2024 due to brand growth system and KHC is expecting 40% growth by the end of 2025. For example, introducing Capri Sun with a 96 oz bottle which is equivalent to 32 pouches at the club retailers as per the demand. By cutting back on sugar and launching in different appealing packaging KHC is investing in Brand Growth System (BGS), marketing and R&D to elevate and enhance their customers experience and improve their sale to support its higher price and margins.

The company’s progress in Emerging Market is positive and there is an expectation of double digit growth with improved returns on the spend by the end of 2025. Kraft Heinz has expanded its Mexican food strategy by providing a restaurant like quality at home experience. Which generated 75% of innovative sales in 2025. Heinz Pasta Sauce contributing 26% of growth, Taco Bell partnership about 12% of growth in Q1 in 2025. Whereas, they have introduced ABC ready to use peanut sauce in Indonesia. KHC has increased their marketing budget by 15% in 2025. Heinz being the largest brand globally recorded $1 billion sales in emerging market a growth of 11% contributing 40% of total sales currently from Heinz. Following with Taco Bell partnership contributing 12% of growth, Heinz Pasta Sauce with 26% growth and in entering Indonesian market with $200 million with ABC multipurpose peanut sauce in Q1 2025.

Philadelphia cream cheese brand grew to a double digit in Q1 with brand like Crumble and Dunkin partnerships in the US Away from Home channel along with an addition of 16,000 new distribution points.

The major challenge KHC is facing now is changing behavioral pattern, preferences. A major shift away from highly processed foods were the key reasons in declining sales and profits.

Due to inflation and trade downs has pressurized people longer than expectations. People are switching to smaller size packs, choosing from lower priced private labels. These pattern are not cyclical but during COVID, at the times of high inflation and times like trade- down period impact sales and profitability.

In 2024 Q3, Lunchables brand took a big chunk of impairment charge due to which KHC is facing a decline in 2025. Negative publicity from misleading interest groups impacted the overall sales by 15%.The recovery will be gradual but focused on rebuilding the trust back.

Kraft Heinz is not immune to the inflationary environment and tariffs implications. Although they are persistently spending on R&D, S,G&A, technology for long term improvement but it has an impact on profits. The spinoff is designed to improve focus and better execution and to embark on new avenues by addressing the existing challenges and unlocking value for its shareholders.

The gradual accelerated Emerging markets to double digit growth is promising along with investing in Brand Growth System to enhance products like Capri Sun, Lunchables.

Risks

After the announcement of Kraft Heinz’s spin off in September 2025 as part of its strategy to improve its operations and separating into two different companies, KHC is going through a major shift in its organizational structure. The spin off must be organized in a systematic way to ensure smooth operations along the way by ensuring there aren’t any significant tax and legal implications. Otherwise accounting, operational and brand transitions can be very costly and require proper management. KHC is hoping to save significant cost and expecting the spin off to make the company more efficient and profitable for its shareholders.

However, the spin off is expected to cost the company $300 million. During this period the cost of maintaining its business operations such as IT, HR Finance and logistics for each one of its subsidiaries will have short term costs rising temporarily which is expected to lower its profit margins, at least in the short term till its materialized and the company is through with the spin off.

Furthermore, during this transitionary period, KHC could face significant production delays, issues with the customer service which could result in loss of sales and also possibly losing some of its market share.

Therefore, in the short term due to lingering spin off news, the investors are not confident enough to invest in KHC’s stock which has lost more than 25% due to uncertainty around its future prospects.

The investors are waiting on the sidelines for the spin off to take place and then value the company based on what’s left (Debt and FCF) after the companies are separated. Therefore, the spinoff could be very tricky if not managed well by the management which could affect the company’s future prospects and its existing shareholders.

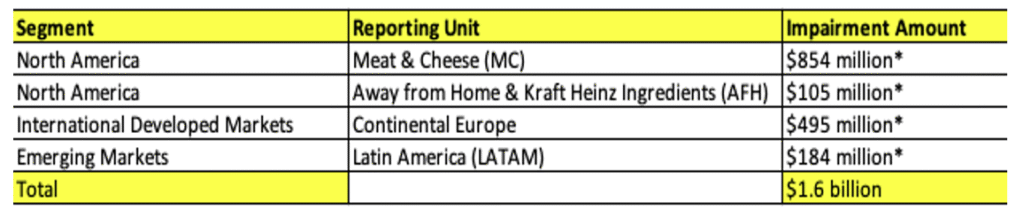

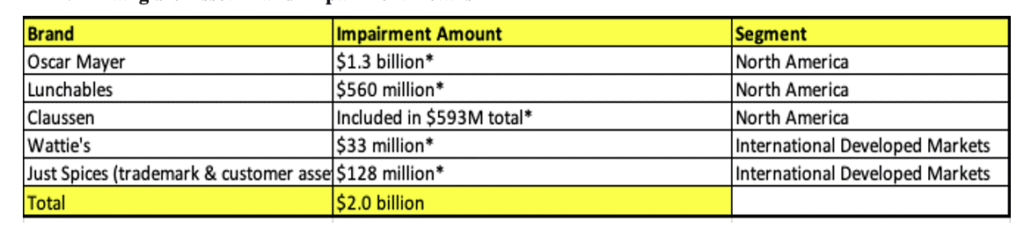

Kraft Heinz made a loss of $3.6 billion during 2024 fiscal year. KHC has booked $3.3 billion of intangible assets impairment loss on the brand Oscar Mayer that consisted the goodwill impairment loss of $1.6 billion and intangible impairment loss of $2.0 billion in the year 2024. The multiple reporting units affected by the goodwill impairment loss is as follows.

- Goodwill Impairment Details

- Intangible Asset Brand Impairment Details

Several factors contributed to impairment loss. In 2024 Q2 result of North America pre-organization KHC ran an impairment test of the FBD and TMA using discounted cash flow method to estimate the fair value, as a result of which a realization of $854 million of non-cash impairment loss in SG&A in North American segment in Q2 2024.

On 30th June, 2024 a loss of non-cash intangible asset impairment of $593 million in Q3 related to brands like Claussen, Lunchables and Wattie’s. The impairment of the bran Claussen was primarily due to an assumption of reduction in the future year margin. The aggregated impairment of these brands carrying forward amount was $1.2 billion after the impairment. In Q4, 2024 an impairment loss of $1.3 billion in SG&A was observed related to the brand Oscar Mayer.

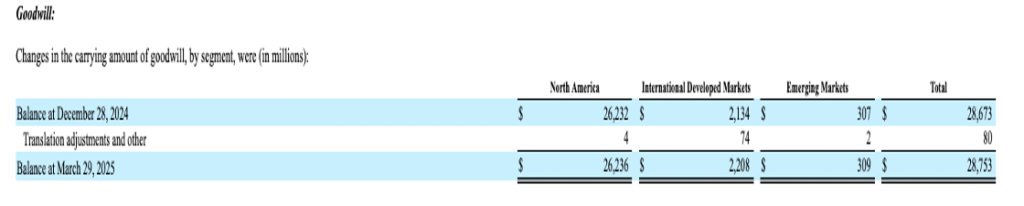

The goodwill carrying forward amount $24.1 billion with 20% or less fair value including Northern Europe, Continental Europe and KHC’s Asia reporting unit carrying amount of $4.6 billion during 2024 annual impairment test.

KHC may expect a low cash flow business generative brands and business units in the future than prior years anticipation.

What should a shareholder expect after a possible Kraft Heinz spin-off and the split in dividends

A tax free spin off was announced by KHC’s board of directors into two publicly listed companies on 2nd September,2025 to elevate the capabilities of the brands while reducing the complexity and also unlocking the hidden potential for their shareholders. KHC will split into two independent companies which will be Global Taste Elevation Co. and North American Grocery Co. their names are yet to be decided. Based on the strategic ambition each company will allocate their capital efficiently for better performance and competitive results. Markets may evaluate each company on higher multiples.

Although, the company has not yet announced the exact ratios of the share split and the dividends. We go by the typical spin off structure. A shareholder will get to keep the existing KHC shares which are expected to become shares of Global Taste Elevation Co. and alternatively a share holder will receive new shares issued under North American Grocery Co.

Share Price

The share value impact right after the spin will be the sum of both companies shares equals to the KHC worth of shares as they were before the spin off. And the US shareholders won’t pay any taxes whilst owning the new shares.

Dividends

Overall the dividends situation will remain the same as per KHC 8-K Q2 2025 report. The current dividend paid by KHC is $0.40 quarterly will is $1.60 per share annually. The future expected dividend will be a combined number from both the companies to reach the current dividend of $1.60 annually. but it totally depends on the free cash flow a company generates. Well, in this case North American Grocery is considered to have a strong and reliable free cash flow. KHC has ample cash flow to invest in the organic growth and return capital to its shareholders. The management is targeting to maintain investment grade ratings for both the companies. Determining the dividend policy the board of each company will set the dividend ratio after the split depending on each company’s strategy.

The dis-synergy will cost $300 million in total. The spin off can be challenging due to smaller and individual approach of the company. Delays can be expected during the split due to its complex nature.

The impairment loss in the fourth quarter recorded was $1.4 billion. Kraft Heinz has indicated about additional impairments of goodwill carrying amount or in definitive- lived intangible assets in its filings, it may have an impact on the financial and future operations. This will not have a direct impact on the cash flows because of the non-cash nature of the loss. But the company will carry the lower asset value impact and it will reflect on the fair value of the asset in the future. The reduction in operating income will have an impact on return on assets, earnings, its credit ratings, re-investment capacity, dividend sustainability and debt covenant. KHC has written down certain reporting units to zero excess fair value over carrying amount.

Source: Annual report

Conclusion

Kraft Heinz has strong free cash flows and a balance sheet with assets that guarantee higher returns in future even after the company is separated. It offers an attractive opportunity to its shareholders and investors because the company is trading well below its fair value.

The company is currently going through major changes and ultimately spin off and split into two different companies which is expected to be completed by the mid of 2026. During the strategic spin off process, KHC is expected to lose $300 million. However, the spin-off is estimated to significantly reduce costs and minimize its complexity to make the company much more simpler and leaner. It will give an opportunity to focus more on its fewer core cash generating brands and on its customers which will benefit its shareholders.

The company is currently trading below its fair value and with the strategic planning it is expected to appreciate by 40% in the short to medium term when its shares are significantly reduced. Although this will add pressure on the revenue for a short time however, with the strong consumer demand and marketable and established brands and products, the company is expected to emerge as a winner after this successful business venture and the tax free spin off.

KHC sustained healthy cash flows post covid 19. Besides cost cutting and cost pressures. The net income during 2022 was $2.36 billion a sharp growth of 133.4% from 2021. In 2023 it was $2.85 billion with 20.9% of increase from 2022. However in 2024, it fell slightly by 3.88% which was $2.74 billion.

The net income and cash flows indicated the demand for Kraft Heinz products.Due to pandemic people were locked in thus, home cooked meals and bakes rose to trending level. It compelled people to buy more products through online shopping to create home cooked meals along with ready meals in minutes using Kraft Heinz products.

However, the challenges remain such as the decline in net income due to non-cash impairment resulting in a significant loss to the company. The company has announced a strategic spinoff of its existing company into two separate entities that will save tax costs. Therefore, it is an opportunity for the event driven investors, to hop on in order to benefit for this situation. The separation of the core business into two separate entities will unlock their true potential due to strong market presence.

Although this dis-synergy will cost KHC a significant amount however, the company is trying to control this cost to ensure the spin off goes through smoothly and efficiently in 2026.

The company has announced a pro-rata distribution of its shares for the existing shareholders. The original shares will be kept with Kraft Heinz but the management will decide distribution of shares in two separate companies after the spin off into Global Taste Elevation Co. and North American Grocery Co.

The board of directors will announce the split of shares and dividends near the official spin off though the dividends will remain the same according to Kraft Heinz recent announcement.

Disclaimer

The information provided by Moods Investment Research is for general informational and educational purposes only. It is not intended as, and does not constitute, financial, investment, tax, legal, or other advice. The content is not a solicitation or recommendation to buy, sell, or hold any securities or investment strategies.

All opinions expressed are based on current analysis and are subject to change without notice. While we strive for accuracy, Moods Investment Research makes no representation or warranty as to the completeness, accuracy, or reliability of any information provided. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Moods Investment Research and its founders, directors, or affiliates are not liable for any losses or damages arising from any reliance on the information provided.

The views expressed in this article are those of the author(s) and do not constitute investment advice. The author(s), including any editors or contributors (collectively referred to as “Moods and directors”), hold a position in KHC and may or may not hold a position in other securities mentioned. Any such holdings are subject to change without notice.